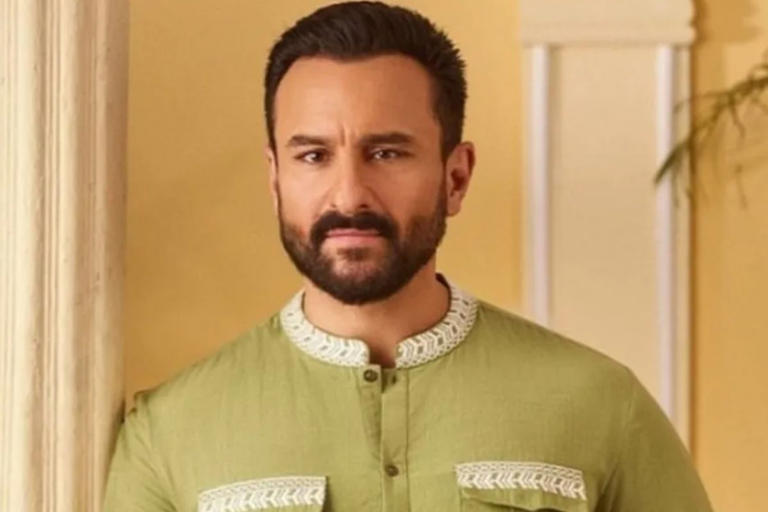

After delicate subtleties from Saif Ali Khan’s medical coverage guarantee were spilled via web-based entertainment, showing that the Bollywood entertainer applied for a case of Rs 35.95 lakh, a specialist unveiled that such a significant sum could never be endorsed for an everyday person by any wellbeing guarantor.

Saif Ali Khan succumbed to a savage occurrence when a gatecrasher broke into his home in Mumbai’s Bandra West and wounded him on different occasions. He was raced to Lilavati Clinic for treatment by his seven-year-old child, Taimur.

A cardiovascular specialist from Mumbai, Dr Prashant Mishra, featured the battles of working class strategy holders and said that Niva Bhupa, a wellbeing safety net provider, could never endorse more than Rs 5 lakh to the everyday person for such medicines.

In a post on X (officially Twitter), he expressed: “For little emergency clinics and everyday person, Niva Bupa won’t endorse more than Rs 5 lakh for such treatment. Every one of the 5-star clinics are charging excessive expenses and mediclaim organizations are paying moreover. result – expenses are rising and the middle class is languishing.”

The mediclaim record submitted for the therapy of the Bollywood entertainer shows a case of Rs 35.95 lakh for his clinical treatment, of which Rs 25 lakh has proactively been endorsed by the protection supplier.

The Times of Dalal Street couldn’t freely confirm the legitimacy of the mediclaim being circled via social media.

Notwithstanding, Niva Bupa Medical coverage organization affirmed the cases and said: “A credit only pre-authorisation demand was shipped off us upon his hospitalization and we have given endorsement of an underlying add up to begin the therapy.”

In December 2024, the 55th GST Gathering meeting delayed its choice on diminishing expenses for wellbeing and life coverage to the following meeting, refering to the requirement for additional explanation. The Council has coordinated the Group of Ministers (GoM) to give extra subtleties to make their report more exhaustive.

The Council said that the matter requires further investigation and definite assessment before any choices are made on overhauling the GST rates or lessening expenses connected with wellbeing and life insurance.